The number of firms reporting shortages of bricklayers has peaked again as the industry enters its seventh consecutive quarter of growth.

According to the latest construction industry trade survey covering all industry sectors there is a severe shortages of bricklayers being reported despite pressures for other trades easing.

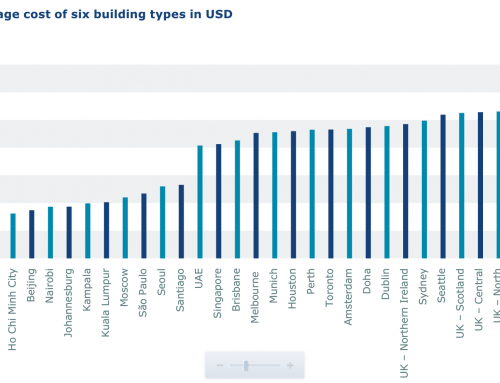

Tender prices also continued to rise across the building and civil engineering sectors with labour and materials prices key drivers of cost pressures.

This morning Bovis Homes reported that mainly wage rates alongside some materials price inflation had driven up house building costs by 7% last year.

The decline in global oil prices in the second half of 2014 filtered through to a decrease in fuel costs for product manufacturers, but this has yet to work its way into contractors’ prices.

Overall, 22% of building contractors reported difficulties recruiting on-site trades in the last quarter of 2014, compared to 31% in previous period.

Once again, they highlighted serious issues in recruiting skilled employees for three key trades.

At 70%, the proportion of building contractors reporting difficulties recruiting bricklayers increased from 41% in Q3 and represented a nine-year high.

The proportion of building contractors reporting difficulties recruiting other on-site trades was 37% for carpenters and 31% for plasterers.

Noble Francis, economics director at the Construction Products Association, said, “Another quarter of growth confirms the construction industry’s strongest performance in six and a half years.

“Activity rose in the fourth quarter compared to a year earlier according to 44% of contractors, on balance, although this moderated from 60% reported in Q3.

He said the rise in activity was still been driven by house building and by the private commercial, the largest construction sector, where more firms are also reporting rising workloads.

“Looking forward, contractors expect continued strength in private housing and commercial this year, boosted by public non-housing as a stream of work on the Priority School Building Programme gets underway. Outside of these sectors, however, order books weakened in Q4, suggesting a moderation in growth in 2015. SMEs in particular reported a noticeable slowdown in new enquiries in Q4.

He added “In addition, only product manufacturers felt the effects of falling oil prices in Q4. Contractors, SMEs and civil engineers continued to report elevated costs, which implies any gains from a wider slowdown in inflation are yet to filter down the supply chain.

“Ongoing difficulties in recruiting skilled on-site trades are also likely to keep upward pressure on costs.”

Stephen Ratcliffe, director UKCG, said, “Cost pressures continue to be a worry largely reflecting skills shortages. That is why UKCG members are focussing their activities on attracting new people into construction.”

Richard Beresford, chief executive of the National Federation of Builders, added, “While the industry is reporting broad-based growth and a strong pipeline of work, it is unable to capitalise on that.

“The rising costs associated with a shortage of skilled labour and for tenders are eliminating the profit advantage that increased workloads bring. With changes to procurement rules imminent, now is the time to see how we can remove unnecessary cost from the tendering process.”

Source: Construction Enquirer